What is the Recontribution to Superannuation Strategy?

As a financial adviser to pre-retirees and retirees, in the last few years we’ve seen an increase in discussions had, and guidance given, to clients around both a retirement, and estate planning strategy involving recontributing funds to Superannuation.

But first we need to understand that our super is made up of two components:

1. A tax-free component (unpreserved): which can include after-tax income, such as non-concessional (personal) contributions or certain government co-contributions. These contributions and their associated earnings are generally tax-free when withdrawn from superannuation, and;

2. A taxable component (preserved): usually consisting of contributions made from pre-tax income, such as employer contributions (including salary sacrifice contributions) and earnings on those contributions. It’s these components that can be subject to tax when withdrawn, depending on the individual's age and circumstances.

It’s important to note here that accessing the taxable or preserved component of an individual’s super account is not possible until that person reaches the preservation age, which is generally between 55 and 60 depending on the year they were born.

You can save on the tax your beneficiaries would have to pay

Photo cred: unsplash.com/@towfiqubarhuiya

How does this strategy work?

The aim of a recontribution strategy is to maximise the tax-free component of a superannuation income stream and/or superannuation death benefit.

According to MLC:

“To achieve this, the strategy focuses on the tax effective withdrawal of taxable components and contributing these benefits back into superannuation as a non-concessional contribution (or another type of contribution) that forms part of the tax-free component.”

What would be the benefits of recontributing to super?

When considering your estate planning, on your passing, if you intend to leave your superannuation to an adult child who is not dependent on you, a recontribution to super strategy is one way to potentially save on the tax your beneficiaries would have to pay.

Without this strategy, the beneficiary can be subject to paying some tax on their inherited super. So, the idea is to convert some of your taxable component of your super into tax free money.

A recontribution to superannuation strategy can make a considerable difference to your non-dependant adult children if or when these funds are inherited.

A case study:

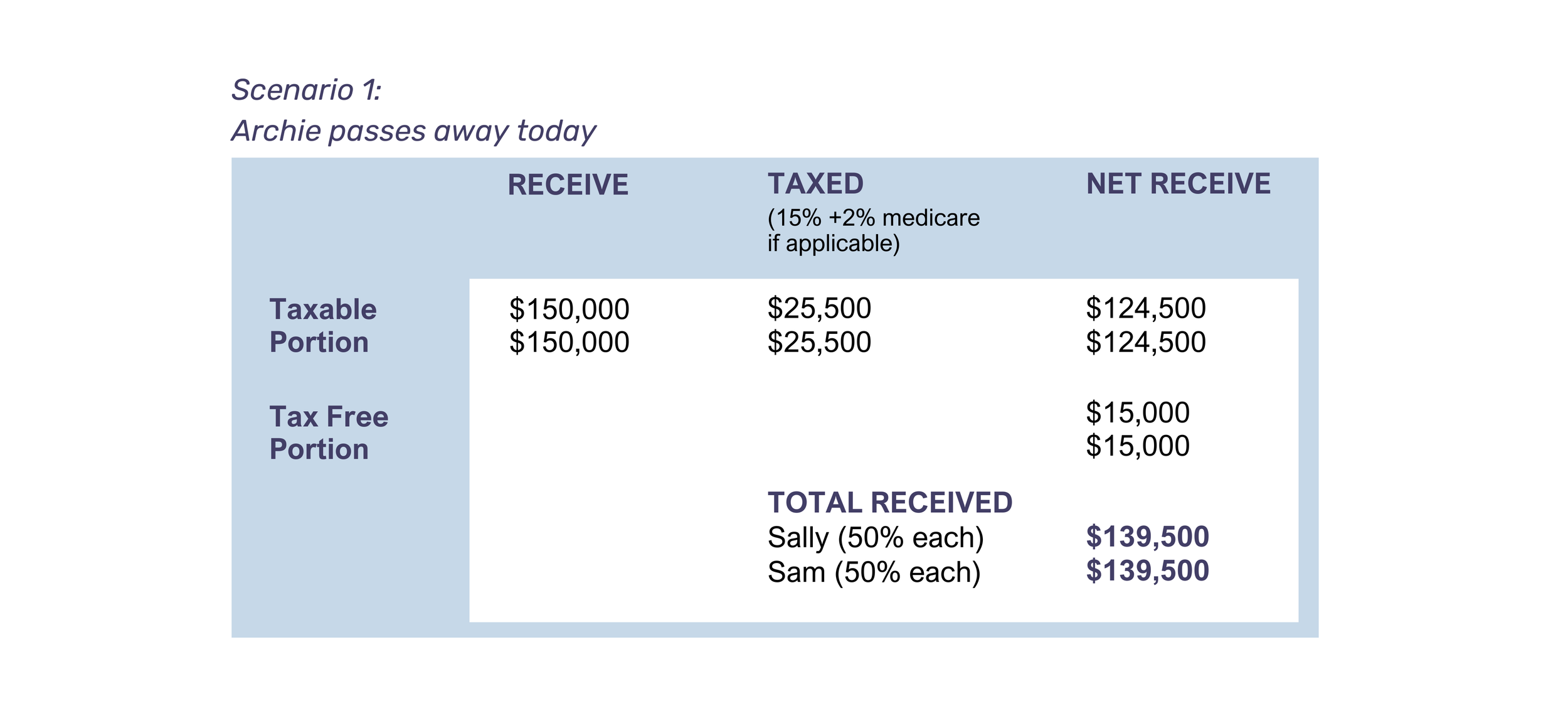

Consider Archie, who is a 67 year old single male with two Adult independent children Sally (44 years old), and Sam (41 years old). Both are beneficiaries and will receive 50% each of Archie’s superannuation on his passing.

Archies Super consists of $330,000 of which $300,000 is taxable and $30,000 is Tax Free.

This scenario shows that using the Recontribution to Super Strategy, Archie has saved Sally and Sam $25,500 each in tax.

If you are interested in knowing more about the ‘bring forward rule’ please visit the ATO Website.

While the focus in this article has been on superannuation death benefits, there are more reasons to consider recontributing to super as a retirement and estate planning strategy. For further reading, MLC have an excellent article that delves into other considerations.

This is just one of the many strategies that we help our clients to achieve. If you would like more information, you may like to book a free discovery call with Thelma from our Albany office, or Harrison from our Perth office.

The information contained in this article is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.

If you or someone you know are experiencing financial hardship or need support to get on track financially, please reach out to Anglicare who can provide free financial counselling.